I don’t feel like I need to add any more fuel to the housing affordability debate, so rest assured – I will stay away from that on this blog post!

But let’s face it – the 2022 Winnipeg real estate market has been one heck of a roller coaster. I would best describe it as volatile – as it has changed rapidly throughout the year with the first two quarters starting as strong Seller’s market, and the third quarter now showing more semblance of a balanced or perhaps even some might liken it, incorrectly so, to a Buyer’s market.

Here’s the thing: the market is ACTUALLY still considered a Seller’s market. It just doesn’t feel like it to those that have witnessed the last several months of real estate craziness. Bidding wars are still happening, we are typically seeing less than 6 months of inventory, and the sale prices are still relatively close to the list price. All of these are market indicators of a Seller’s market. However, if you were listening to stories from early in 2022, you will have heard of 20 or more offers on some homes with many selling for $100,000 over list price. So, when a home sells in under 20 days for 1-2% below list price, it doesn’t sound as exciting for our Sellers. The market has certainly changed – and it was a good time while it lasted – for the Sellers.

I personally, will always prefer a balanced market. I like when there is logic and rationale behind Buyer behaviour. I also like to see homes being listed near fair market value. There is nothing that drives me more nuts than underpricing to try and drive a bidding war, or overpricing and just assuming it will sell anyways because the market is “hot”. Balance is where there are many options out there for Buyers to compare, and reasoning wins out. Balance is where Agents that REALLY know their market tend to excel.

Let’s face it – the last two years have been anything but typical. We all thought when COVID set in, that houses would stop selling. Who wants to buy a house in a pandemic, right? I’ll tell you who: Savvy buyers who realize the opportunity presented when mortgage rates are at all-time lows. I think we seriously underestimated just the power of low interest rates – even in the face of a pandemic. However now, we are seeing that same responsiveness to interest rates now that they are increasing.

Next week, we know that the Bank of Canada will be making one more announcement about their key lending rate. Most speculation, and I agree, is that rates will likely go up by 0.5-0.75%. I would agree with that and I wouldn’t be shocked if they went on the more aggressive end of the spectrum, as inflation is still out of control. Given the previous increases this year, the combined increase from January 2022 until now, we have seen the Overnight Rate increase by 2.25% in 8 short months. With next week’s announcement, we will likely be sitting at close to 3% since the start of the year. This might not sound like a lot, but when put in perspective for home buyers, we have to look at the impact it has on their mortgage affordability. The average sale price in Winnipeg as of the July report was right around $400,000. With a 5% down payment and good credit, a buyer would have likely had monthly mortgage payments of just under $1800. However, with current rates we are talking about adding $400 - $500 to that monthly payment. This has a huge impact on what Buyers can afford, and will of course have a downward impact on just what they are willing to pay.

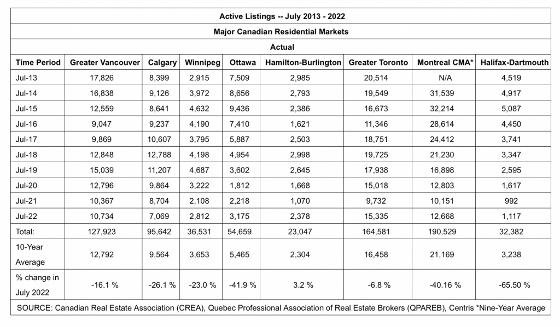

Interesting enough, Winnipeg is reporting that its’ actual inventory is down 23% from it’s 10-year average, according to the Canadian Real Estate Association. At the end of the day, this is a supply and demand issue that we are facing in our more immediate future. With net positive migration planned again for 2022 and 2023, overtime we might continue to see more of these boom cycles. In fact, Canada Mortgage and Housing Corporation, CMHC, concluded that Canada needs to build around 3.5 million new homes by 2030 to tackle the affordability issues that many Canadians are seeing.

So how many homes do you think we are building in Canada per year right now? The stats are in, and we are averaging between 200,000 – 300,000 new doors per year. A serious deficiency based on the projected required housing moving forward. This is a Canada-wide problem, not just a Winnipeg-based problem. But in my opinion, what is being done to manage the housing shortage, by increasing interest rates is ultimately not the solution. Until our housing starts start matching the needs of our net migration in Winnipeg and in Canada, we are going to continue to see these boom cycles over and over again.

But mark my words, these increases in interest rates will put more strain on the rental markets – and as we start to see those rents climb and interest rates stabilize, we will again see a resurgence in the market. Interest rates are a Band-Aid fix – but not a long-term solution. I personally think that if you plan to buy and hold Real Estate that it is still the most solid investment you can make. And those that feel the market is overheated now, will be kicking themselves for not buying now, 10 years from now.

It is also worth mentioning, that Winnipeg is one of the most stable real estate markets in all of Canada. In years where other markets were seeing massive boom and bust cycles, our values rose slowly but steadily. It does make us a boring market to report on – and perhaps that is why so little is reported on about the Winnipeg Real Estate Market – but I like it. Slow and steady wins the race! I read a statistic that in the last 50 years, there have only been 3 years in which the average sales price declined – but it was followed by a rebound that far surpassed the decline in the following year. Those years of decline were in years of high interest rates – and we are anticipating to see a slight decline in Q4 and into 2023 largely due to the aggressive interest rate hikes. However, mark my words on two things: 1. As the market adjusts when interest rates stabilize, we will start to see more buyer confidence and homes starting to trade as they did at those 2019 rates, and; 2. Winnipeg will fare far better than most markets in Canada. We are hearing predictions from other Provinces that their property values will decline close to 25%. I would anticipate declines, but nowhere near that. I would be surprised if we are even into the double digits.

So there. I said it. I put my predictions in writing. I might cringe in a year or so reading this, but if history is the best indicator of the future, I think Winnipeg will come out of this relatively unscathed.

Agree? Disagree? Let me know! I would love to hear your opinion!

Want more advice in this regard? Whether or not it is a good time to buy or to sell? Feel free to reach out. Every situation is specific, and we are happy to take a consultation and provide you with honest advice as to what your best options are!

#AgentJen

#AgentJen

Jennifer Queen

Phone: (204) 797-7945

Email: Jennifer@JenniferQueen.com

-587-wide.jpg)